TradingView Price Action All In One Indicator

If you are the one who is “Price Action” style & does not want to use many indicators or complex indicators or you are an ICT student or ICT charter, this simple beautiful AIO Indicator is right for you.

Register Link: https://aioindicator.com

My email: tranholenguyen@gmail.com

My Telegram Channel: https://t.me/aiotradehub

Contact me on Telegram: https://t.me/nguyenthl

The indicator has the following functions.

TIME ZONE SETTING

The default timezone is New York Time GMT-4, if you leave the time zone setting blank, it will use the symbol timezone. Note that the trading time changes with one hour delay in winter. so if you just trade forex, and leave the time zone setting blank, TradingView will adjust the symbol timezone automatically for you, or don’t forget to change the timezone setting GMT-4 or GMT-5 depending on daylight saving time.

BREAKOUT PREDICTION

The indicator will show its prediction of whether the price will break the previous high/low with the win rate.

You also can choose to show others’ timeframes prediction: 1h, 4h, D, W. Personally I use Day, Week Prediction and form the trade in the lower timeframes.

STATISTIC PANEL (https://bit.ly/3KeKpHI)

You can choose which panel to show through settings.

Breakout Info Panel: Whether or not the previous day's/week's high/low is broken.

Session Info Panel: pips info of ADR, Asian, London, and New York sessions.

Trend Panel: showing trend (up/down) of

5m/15m/1h/4h/D/W time frames (TF).

4 MA (default values: SMA with lengths: 20–50–100–200)

Money Management Panel: in trading, money management is very important. Just put the % risk, & stop loss value below, the indicator will calculate a suitable size/amount for each trade.

- Size by Lots: input stop loss in pips

- Size by Units: input stop loss in % (of price)

(*) Units size is calculated by % stop loss & current bar close price. You have to determine stop loss price to convert to % stop loss by yourself.

Of course, the colors, position, text size of the panel can be changed to whatever size you like. The default size is small. If you use a 4k/5k monitor, maybe you like to change to a larger size.

TIME SEPARATORS (https://bit.ly/3ubcgTH)

We can choose which time separators we want to display. The indicator has 5 options: Anchor Time/Day/Week/Month/Quarter. Of course, we can choose to show just one or all 5 of them. The color of each one can be changed.

With Anchor Time you can choose which time you want to draw a vertical line for better timing analysis. This can show up to 2 Anchor Time lines. The default values are 00:00 (New York Midnight Opening) and 08:30 (New York Session Opening). You also have an option to show the past lines or not.

About Day Separator, cause TradingView has supported Session Breaks in Setting but if you don’t like to use it or when enabling, it distracts you, you can use mine. My favorite trading dates are Tuesday & Wednesday.

The advantage of my Date Separator over “TradingView Session breaks” is TimeZone setting, you can set it to whatever time zone you like, and the session will change accordingly.

With Daily Separator, The indicator has two options to show. You can choose to show just one or each of them

Daily Separator by Time Zone with the text from Mon, Tue,… Sunday

Daily Separator Vertical Line. You can choose to show separator lines using market time like TradingView Session breaks or using timezone

PRICE LEVELS (https://bit.ly/3NMDV57)

For intraday trading, the high/low/close of the previous 1H, 4H, day, the previous week, ADR (default period is 5) are very important key levels. You can choose which one you like to show for better analysis. Of course, you can change the color & style of the lines. This is also my favorite indicator.

With each previous range data (day/week/month), we can choose to show or not equilibrium level.

This indicator also has an option to show up to 2 price lines at a specific time, you can choose the price type (high/low/close/open) that you want to display. The default time values are:

Specific Time 1: 0:00. (New York Midnight Opening Price)

Specific Time 2: 8:30 am. (New York Session Opening Price)

NWOG or New Week Opening Gap is also available in Price Levels. You can choose to show up to 5 NWOG & show or not show C.E. — Consequent Encroachment or level 50%/midpoint.

ACCUMULATION ZONE (https://bit.ly/3x0Njw6)

The market tends to reprice the higher/lower to the old high/low or imbalance/fair value price to promote buy/sell stops or to provide smart money pricing for long/short entries. Typically, it redistributes quickly and you must learn to anticipate them at key levels intraday. Weak short/long holders will be squeezed in the retracement.

Except for the open price, the price changes continuously until the closing time, so the accumulation area can also be changed in real-time, but if you combine it with other information when analyzing, you can predict/determine whether the zone has been established or not with high probability. In short, the price needs time to be accumulated, I usually don’t pay attention to this daily zone till London open/close or New York sessions

Not only daily zone, but the indicator also supports higher timeframes accumulation zone from [Auto→D→W→M→3M→6M→12M]

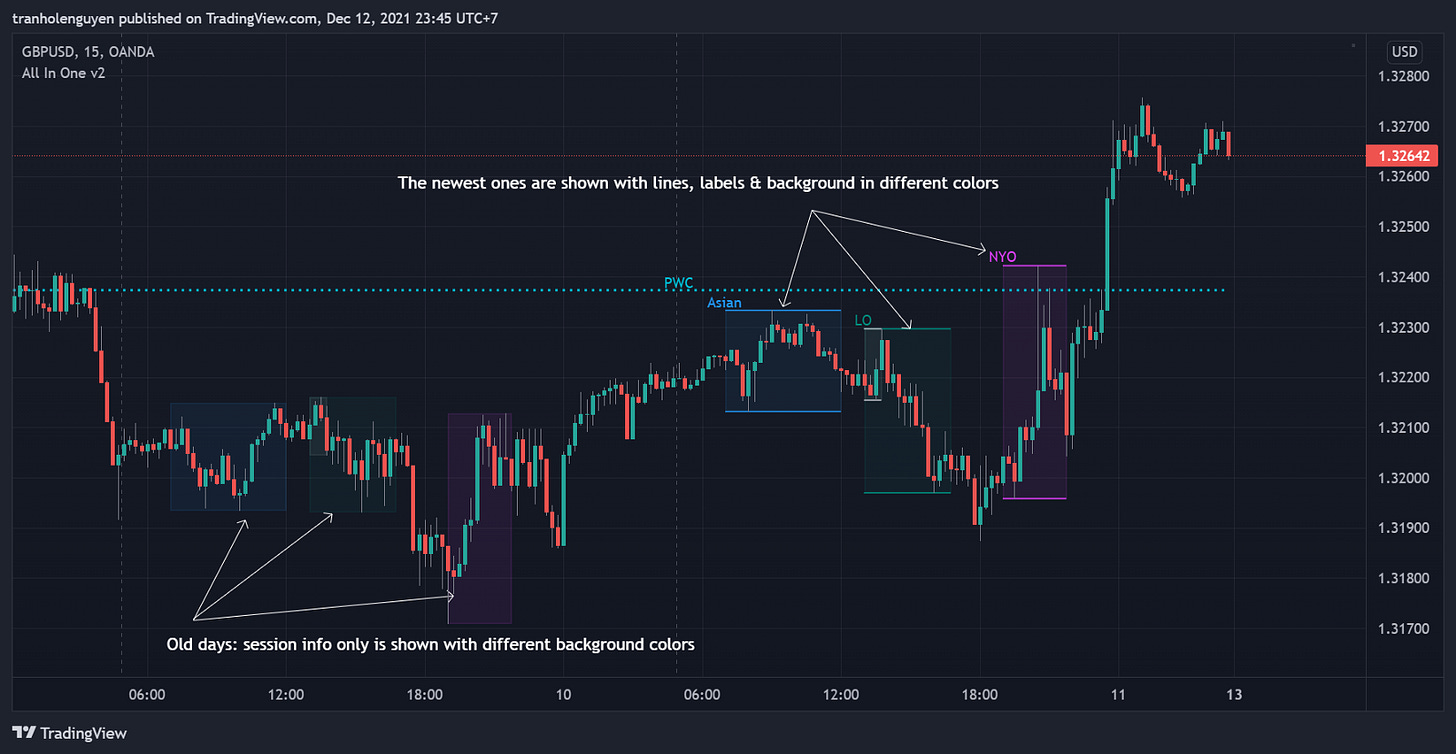

SESSION & STD (https://bit.ly/3LFGiVB)

There are 7 sessions. The default values are below (New York Time).

Asian: 19:00 ~ 00:00

London Open (London KillZone): 01:00 ~ 05:00

New York Open (New York KillZone): 07:00 ~ 10:00

DR/IDR: 09:30~10:30 (day high or day low is formed in this session with high probability)

ODR/IDR: 03:00~04:00

ADR/AIDR: 19:30~20:30

If you do not want to show the label, just leave the label values blank or change them to whatever you want. For each session, you can also choose to show top/bottom close price & equilibrium price level.

This is one of my favorite functions. I use it on 5m, 15m, 30m, 1h TF for Forex intraday trading. My favorite trading sessions are London Open & New York Open.

You also can choose to show or not Standard Deviations (STD). The default values are set for Asian Range STD and max STD levels can be shown are 5. I usually use the following 4 types of STD (New York Time):

CBDR (Central Bank Deviations) STD: 14:00 ~ 20:00

Flout STD: 15:00 ~00:00

Asian Range STD: 19:00 ~ 00:00

IDR: 09:30~10:30

LOOKBACK HIGH/LOW/MID (https://bit.ly/3Kf6Z2T)

Can show high/low/mid of the data ranges on the daily/4h chart. The default values are:

20–40–60 days back from today for daily TF.

30–60–90 bars back from the latest bar for 4h TF.

The default anchor bar for calculating the lookback is the latest one but with:

4h TF: we can change the lookback from the 1st day of the week.

Daily TF: we can change the lookback from the 1st day of the month.

The indicator also has options showing the high/low/mid (equilibrium level) lines for better analysis. Especially, on daily TF, we have the option that can show up to 4 lines (25% for each one) of the data range.

Of course, you can change the colors or the style of the high/low/mid lines.

The lookback can be shown on the lower TFs for better detection when the market structure is shifted.

MAGIC BANDS

One of my favorite indicators. The bands changed color based on the trend & you can use it as a factor for better analysis. The default period value is 34. You can choose to show/hide the sub-band (the gray one)

How I use it? I use the trend-band to identify and trade retracements & sub-band for potential profit-taking points. I usually use it with multi-timeframes analysis to find a good entry.

MAGIC BARS (https://bit.ly/3r3S5Fa)

Fractal bar: The bar’s color is changed when the divergence occurs between the price & RSI. You can change the RSI period (default value is 14) & RSI source. (open/high/low/close,…)

Imbalance bar or liquidity void or fair value gap (FVG) — whatever you call it. This is my favorite indicator when trading on all TFs. You can choose to extend the last n imbalance bars or hide filled imbalance bars if you like in the settings.

Trend Bar: coloring bars based on many available options like Moving Average (MA) values, MA Cross, Market Structure (CHoCH or BOS), or Magic Bands. It’s really helpful if you want to filter the trend by bar color.

MARKET STRUCTURE

Old High/Low enabled: Detect the next buy/sell stops that Market Makers aim to manipulate. Suitable if you set the Period to a small value.

Market Structure enabled: Detect whether market structure shifted or not (Break of structure (BOS )and Change of Character (CHoCH)). This is one of my favorite indicators all the time. It just shows the lines when you really need it, I really love it, so beautiful.

This indicator supports up to 2 periods to show up to 2 market structure shifts. I call them: Sub-Structure & Swing-Structure

It also has

“Show Liquidity Sweep” which can help you filter potential Liquidity Sweep level or fake Break of Structure

“Protection Lines” which can help you determine the current trend is continuing or not.

TRENDLINES (https://bit.ly/37impVu)

A very simple trendline with default pivot left strength is 10.

By default, trendline uses high/low price but you have the “Using close price” option.

SMT Divergence

SMT or Smart Money Technique Divergence. It displays divergence between two symbols like S&P500 vs NASDAQ 100.

Zig Zag

Can show up to 2 ZigZag lines.

This is suitable for traders who have difficulty in detecting key levels (recent high/low) of the prices to confirm market structure or just for drawing Fibonacci easily at those levels.

MA (Moving Average)

I believe that this is one of the most used indicators for every trader. There are 5 types of MA to choose from: EMA, SMA, WMA, VWMA, SMMA(RMA).

This can show up to 4 MAs. You can choose the source (close/high/low,…) for each one. My favorite values are 34 & 89 EMA.

This indicator also supports MA Bands & MA Ribbon. You can select which MA you want to display the bands, and the “width” of the bands can be changed via the settings.

VWAP

The indicator has two VWAP options: Anchored and Rolling. You can choose which one to show.

Others/known issues/limitations

In forex or stock (things that are traded only on weekdays), TradingView’s [dayofweek. Friday] does not include the latest bars till Monday so the Day Separator cannot fill that space. Because TradingView deals with those bars as Sunday ones so I set the color of Sunday the same as Friday for good UI/UX. On Crypto charts, the indicator shows without problems.

You can see the images below that show I have tested my indicator from 1-minute time frame, enabled all functions, and changed every setting to max values & everything still works fine.

Some Mobile Screenshots

Some samples of how I use it everyday combined with my analysis

—

Nguyen Tran